Perhaps one of the most interesting things about starting an investor relations career is that it’s a bit of a functional orphan. When you look across other functions in a typical business, whether it’s sales, marketing, finance, accounting, treasury, or HR, most of those folks have worked their way up to the leadership role in that profession via a combination of targeted experience and education.

A unique aspect of an investor relations career, however, is that in our field, there generally isn’t a clear path to the leadership position, and no one goes to school to be an Investor Relations Officer (IRO). As a result, IROs come from a widely diverse set of backgrounds, including marketing, the sell-side, treasury, communications, finance, and a host of other areas.

This situation makes peer advice even more valuable for IROs who are starting a new position. We reached out to Q4 clients to get their thoughts on what they wished they’d known when they started in IR.

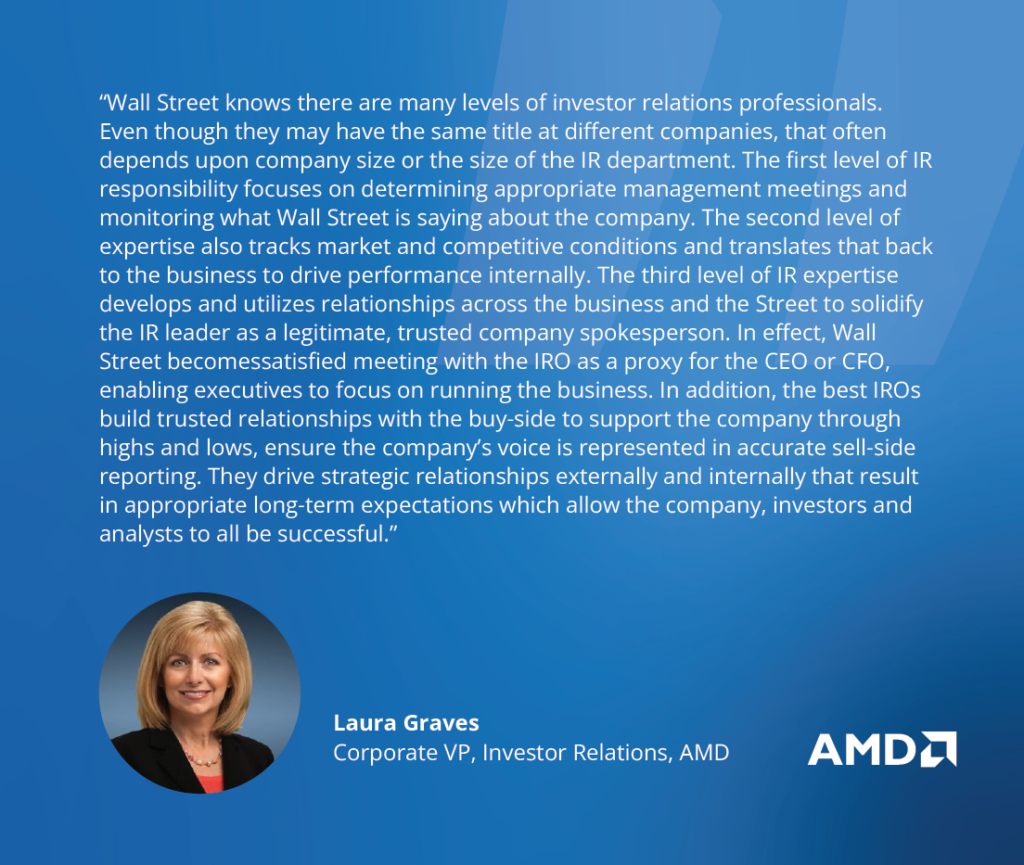

Levels of responsibility in investor relations

We all strive to gain that golden “seat at the table” that Laura alludes to and be viewed as a strategic partner to both leadership and the Street. The first two levels that Laura mentions should be viewed as building blocks in a career trajectory to become a successful leader running an IR team. This approach ultimately results in a well-rounded IRO who functions as a valued proxy for both a CFO and even a CEO to investors and the Street.

Use the investor’s perspective regarding your company’s investor relations

Putting yourself in the shoes of the investor is something every investor relations professional needs to understand. So often, we see companies talk about what they want to talk about, which is not necessarily what investors are thinking about. By encouraging an investor-based thought process, this approach catalyzes consistency and candid conversation. It also leads to stronger relationships with your investors as alignment of interest becomes obvious to all involved.

I love the fact that Ruth reminds us that perfect IR doesn’t exist. Tailoring your program to the needs of your executive team, industry, and investors is wonderful advice and will result in the efficient delivery of a strategy designed just for your company. In addition, industry and professional organizations can be critical. For instance, the most recent NIRI conference gave us some great insight into the future of IR strategies. I continue to use the community as a sounding board to remain aware of trends, regulations, and approaches. So get out there and network!

While the IRO is charged with framing and communicating the investment thesis, business milestones, future outlook, and overall financial performance of the company, that doesn’t mean the IRO needs to do it alone. Today’s IROs use multiple internal colleagues across their organizations to test the validity of how they tell the company’s story. They’re open to pushback and suggestions.

The IR community and Wall Street rely on relationships and reputation. One way to prepare yourself for being an IRO is to ensure that you remain honest, candid, and help the organization and your stakeholders achieve common goals. This will pay back in spades as you make your way through your career. Take good care of those around you, and they’ll do the same for you.

Pay attention to the soft skills

As you can see, very little of this advice fits into the hard skills category, and there’s a good reason for this. The IR professionals we work with on a regular basis are smart, conscientious folks who have been plucked out of other functional areas because they have a special combination of skills that make them well-suited to investor relations. One of the things that these and other successful IROs understand is that paying attention to soft skills is what can truly make a difference in their careers.

Check back for Part 2 of this series, where we’ll bring you additional advice and wisdom from other Q4 clients and industry luminaries. Interested in more thought leadership from Q4? Check out our additional blogs.

Also, you can review a recent webinar on the topic, “What You Should Know as an IR Professional“