What’s the purpose of a Q&A session during an Earnings call?

Most public companies typically allow their covering analysts to participate in a Q&A session at the end of their earnings call. Analysts ask questions during these conversations to gain investor sector insights into the company’s strategic viewpoints, validate guidance assumptions, assess risks and opportunities, and ensure C-Suite transparency, ultimately aiding investors in making informed decisions and evaluating the company’s financial health and strategic direction.

Why do I need to prepare for an Analyst Q&A ahead of my earnings call?

Preparing for earnings call Q&A with analysts offers significant benefits to any organization. It ensures effective communication, enhancing credibility and messaging consistency, which, in turn, fosters investor confidence and trust. By anticipating analyst questions and formulating well-thought-out responses, a company can manage market expectations, mitigate risks, and navigate potential pitfalls during the call with agility.

Effective preparation is a cornerstone of IR, and that also carries over to concentrated public discussions like an earnings Q&A. A successful Q&A that projects sustainable growth in a company’s future will directly contribute to a positive market perception, potentially influencing stock valuation, and strengthening relationships with shareholders and analysts alike.

Understanding the importance of prepping for Q&A ahead of time, how exactly do I go about this?

Q4 is already making earnings preparation easy for our client base by consolidating trending topics, macro trends and key management commentary in earnings conversations across various investor sectors into one easy-to-read report. The industries currently in coverage are:

- Materials

- Software & Services

- Consumer Discretionary Distribution and Retail

- Insurance

- Healthcare

(See Appendix for top 10 industry topics by sector)

In Q4’s distinctive question-by-question analysis approach, the key steps involve comprehensive data collection of transcripts from various companies in the above target investor sectors, followed by thorough transcript analysis for Q&A topic-identification using Q4’s proprietary techniques and leveraging AI tools for each analyst question. Subsequently, the analysis focuses on identifying recurring themes and patterns within these questions and its associated topics, highlighting trends that can be used to understand what the market focus is and the types of questions to expect.

Findings are consolidated into sector-specific summaries that highlight key discussion topics and provide insights into how companies addressed similar questions and framed their messaging. By comparing these trends across sectors and analyzing over 1,800 analyst queries, Q4 facilitates benchmarking and equips clients with actionable insights to prepare effectively for their own earnings calls— aligning communication strategies with their investor sector and anticipating questions based on peer practices.

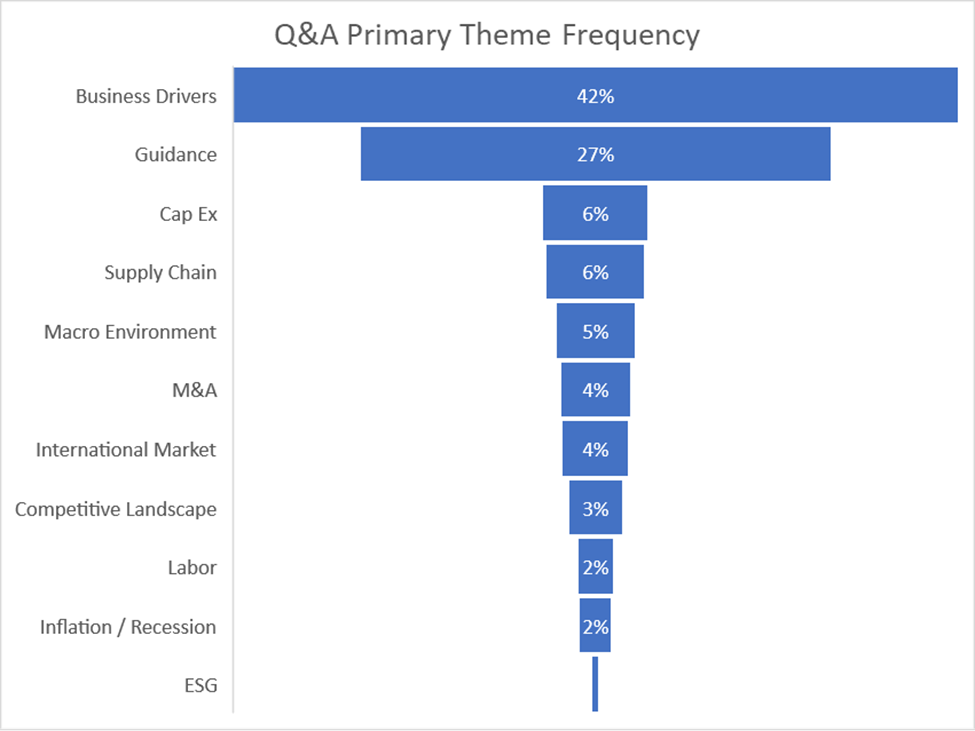

While we look at company-specific secondary topics per question across our watchlist of companies, each analyst inquiry is also classified under a primary topic classification, which informs us on the frequency of conversations around overarching themes like Guidance, Macro Environment, Inflation, Competitive Landscape among many others.

Below, we have consolidated the primary themes across all monitored investor sectors, showing relationships between overarching topics and the frequency at which they were discussed:

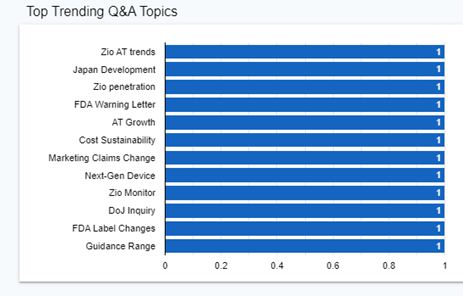

As a sneak peek of the level of insights available in Q4’s proprietary Q&A Trends Analysis, we consolidated the most frequently mentioned question topic from Q&A in Q2’23 across three investor sectors in our current watchlist.

Tech x AI

In early 2023, the public release of OpenAI’s ChatGPT marked a revolution across many investor sectors, cautiously hinting at what’s to come in the near future and the disruption that awaits. The tech sector is under the heaviest scrutiny during this period as they are at the forefront of accessing AI tools to make their products and services more robust.

16% of all questions posed to software companies revolved around Generative AI in Q2. Saas Growth, SaaS Transition and Cost Savings were other topics that were also top of the list.

Earnings Q&A sessions among companies in the Software & Services sector prominently featured discussions surrounding Generative AI products and AI project pipelines, reflecting the sector’s increasing reliance and peaking investor interest on AI-driven innovation. Analysts posed questions seeking to gauge the strategic importance of Generative AI and its potential impact on company growth. They inquired about pricing models, revenue contributions, and the practical application of AI in streamlining implementations and facilitating cloud transitions.

Companies in the sector were under scrutiny to demonstrate their ability to harness Generative AI effectively. Analysts questioned their strategies for leveraging AI to enhance enterprise-grade features and remain competitive in an evolving landscape. Additionally, questions probed the role of AI as a connective force in driving adoption of non-core products and holistic pricing packages.

The responses from C-Suite executives indicated a profound awareness of AI’s transformative potential. Companies strategically embraced Generative AI to drive innovation, optimize operational efficiency, and secure their competitive position in the market.

Materials x Demand & Revenue Growth

The Materials sector witnessed a prominent and recurring theme in its earnings Q&A discussions during Q2 – a keen focus on product demand and revenue growth, covering 27% of all questions asked during this earnings cycle from our watchlist. Analysts across various companies within the sector consistently probed executives for insights into the robustness and sustainability of demand trends.

This scrutiny extended to both commercial and residential segments, with particular attention paid to North American commercial water heaters and the definition of “normalized demand” in the residential water heater market.

Additionally, analyst questions centered on revenue growth guidance and the factors shaping it, such as acquisitions and market dynamics. This analysis is specific to the companies in the Material sector that were included in our watchlist, but it also speaks to the overall sentiment in the sector and the metrics that are being focused on the most. This collective emphasis on product demand and revenue growth underscores the sector’s dedication to navigating changing market landscapes and devising strategies to ensure long-term growth and competitiveness. It also reflects the sector’s proactive approach in addressing these pivotal elements in its earnings communications.

Insurance x Loss Ratio

The Loss Ratio in the insurance sector is a vital metric that measures the relationship between claims paid out by the company and premiums collected from policyholders. It serves as a key indicator of an insurer’s financial health and profitability. A lower Loss Ratio signifies effective risk management and underwriting practices, indicating potential profitability, while a higher ratio may raise concerns about underpricing or excessive risk. Insurance companies closely monitor their Loss Ratios to make informed decisions about pricing, ensure regulatory compliance, and maintain investor and stakeholder confidence, making it an important metric of discussion during earnings Q&A sessions.

During Q2, Loss Ratio was at the forefront of many discussions, specifically covering 24% of all questions in companies within the Insurance sector that we monitored. Analysts sought insights into the sustainability of changes in the accident year loss ratio, particularly when excluding catastrophic events, and asked about the impacts of evolving business mix on this metric.

Additionally, discussions centered on the relationship between renewal rate changes and loss trends, with a focus on discerning trends in the gap between written rates and loss trends. These comprehensive discussions highlighted the significance of the Loss Ratio as a central performance indicator in the insurance sector, reflecting the sector’s commitment to understanding and addressing its nuances in an ever-changing economic landscape.

Earnings Q&A sessions play a vital role in providing investors with insights into a company’s strategic outlook, risk assessment, and financial health. Preparing for these sessions is essential to ensure effective communication, maintain credibility, and foster investor trust. Q4’s innovative question-by-question analysis approach facilitates this preparation by consolidating trending topics and management commentary across various investor sectors.

This unique approach provides companies with actionable insights to align their communication strategies with sector trends and anticipate analyst questions based on peer practices. Overall, understanding the evolving landscape of Q&A discussions and industry-specific trends is essential for companies to navigate their earnings calls successfully, project growth, and strengthen investor relations.

Appendix

Summary of question topics from Q2 ‘23 earnings calls by investor sector.

Materials

Software & Services

Consumer Discretionary Distribution and Retail

Insurance

Healthcare