2022 was a landmark year for investor activism, as 235 campaigns aimed at shaking up public companies were launched – a 36% increase YoY and the busiest year since 2018. Emboldened by the SEC’s new Universal Proxy Rule, U.S activist volumes set records and involved a broader set of players, making preparing for an activist a high priority. 135 new campaigns were launched in the U.S alone, up 41% YoY. Most notable were the stark increases in U.S campaigns aimed at changing board leadership or influencing corporate governance factors like board tenure, executive severance, shareholder rights, and ESG.

Activism in Europe also set records. 60 issuers were targeted by campaigns, up 20% vs 2021 and surpassing 2018 records.

Despite ongoing recoveries in markets and the MSCI World Index inking a 7.9% gain in Q1 2023, activists continue to pressure boards and leadership teams globally. As more issuers wade through the questions being asked of them around governance, board leadership and performance, it has never been more important to start preparing for an activist.

Q4’s work with hundreds of global clients to ensure activist readiness has given us a unique insight into what it means to be ready. Here are several considerations to help you navigate your own activist readiness strategy.

Know Your Audience and Assess Vulnerabilities

Preparing for an activist threat starts with knowing who the most important activists are and how they might approach your company. Every activist is different. Given the rise in first time and non-traditional activists, prioritizing who is most important is critical to driving a focused response strategy.

Establishing a list of activists to monitor is one of the first steps necessary to ensure readiness. By building a “target” list and refreshing it frequently, you can cast your net across a broad set of players and can uncover the key issues you may be compelled to address.

Every IR team understands the value of looking out for activists actively, but building a recurring cadence of preparation in a structured way may not be a high priority due to the level of effort involved. From our experience, this is especially true for small IR teams with limited resources and countless other priorities like increasing the profile of their investment story, revamping their outward presence, or having to re-educate investors following a valuation rerating due to a fall in share price.

A leading surveillance provider like Q4 can help IR teams become familiar with the spectrum of activists they should track based on what’s important to them, their peer group, recent campaigns, or the shape of their company’s financial profile.

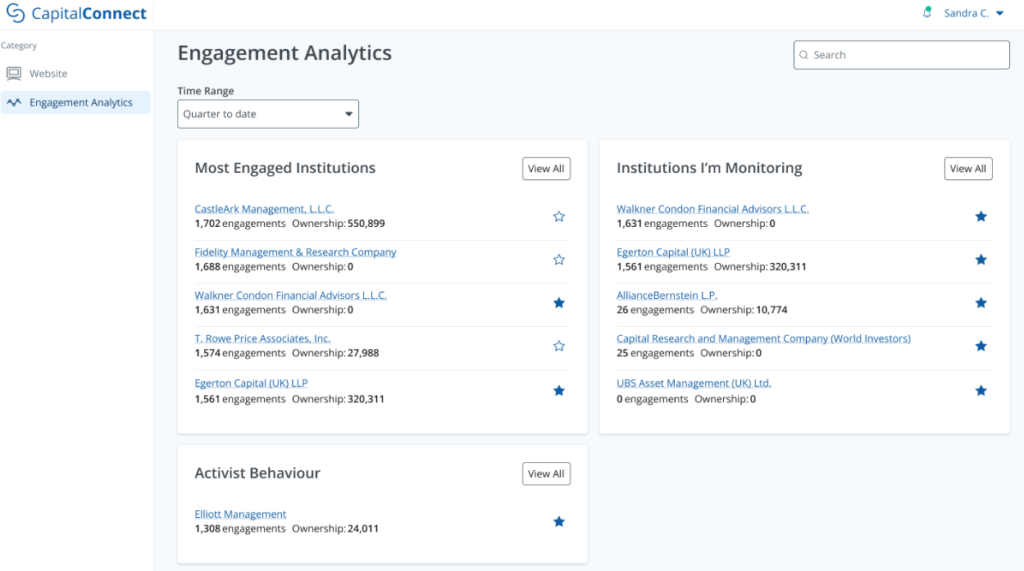

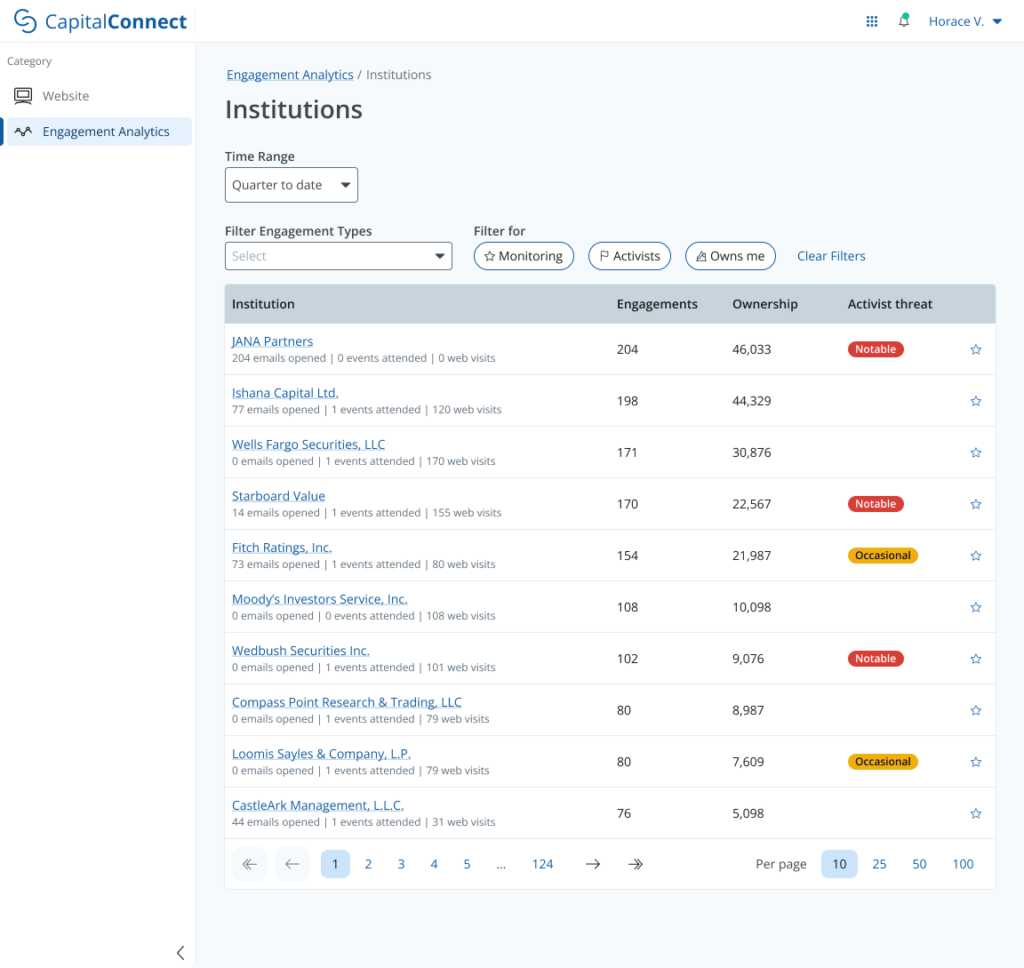

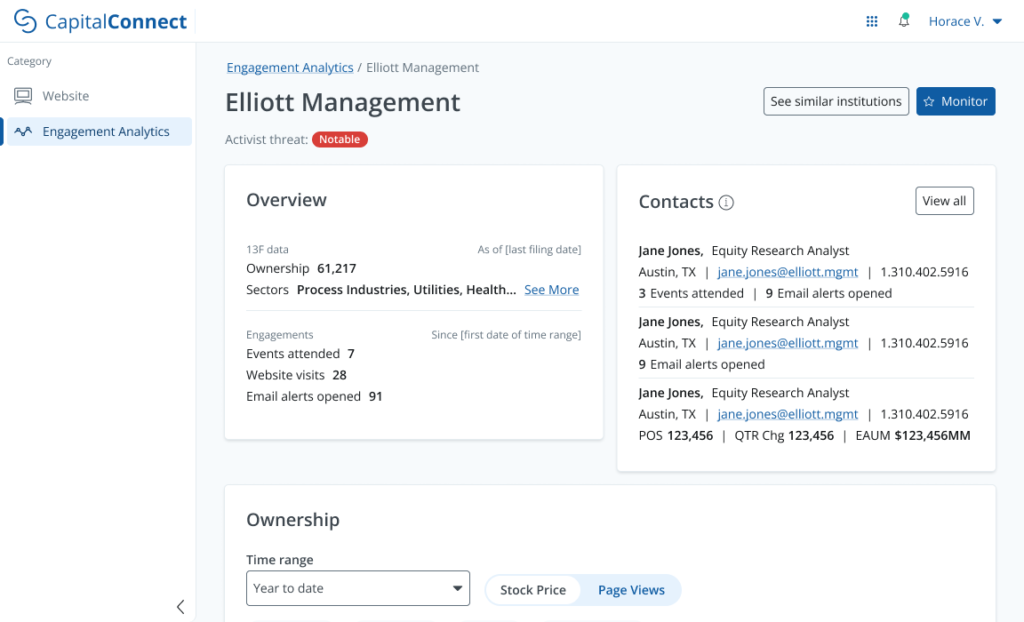

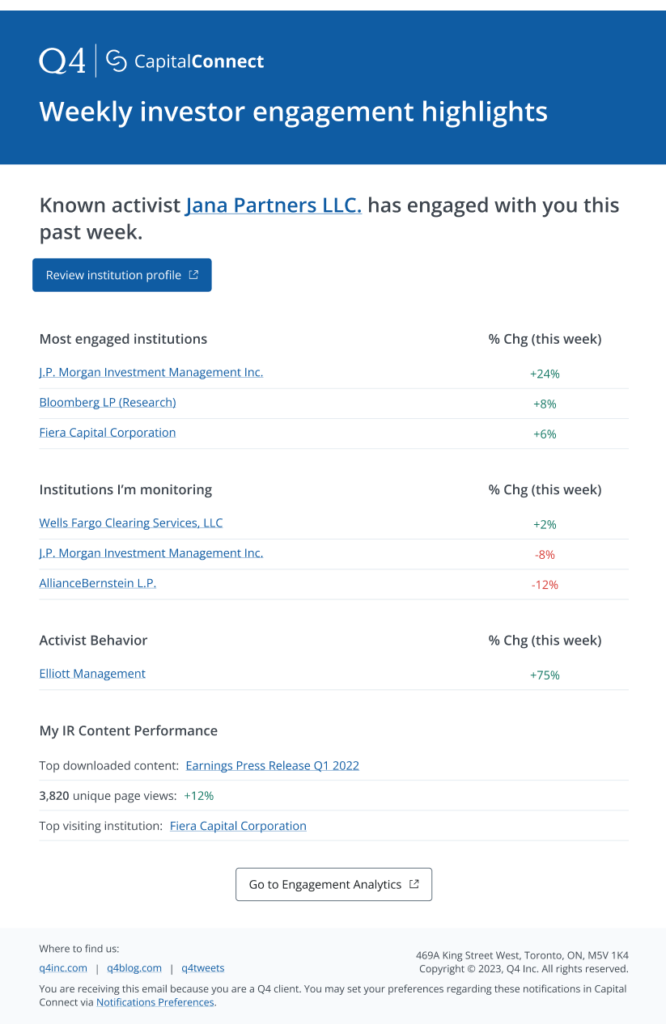

A seasoned surveillance team can make all the difference in helping IR get a sense of which activists may be targeting them. Additionally, new and innovative IR tools like Q4’s Engagement Analytics can help IR augment the analysis of a current surveillance provider by providing a self-serve way for IR to get early warning notifications if an activist is taking notice. These two solutions can help ensure IR is always on the ready to react and strategically respond in a way that makes most sense for their IR program.

Build Your Playbook

Once you’ve identified who could be the most important activists, you’ll need to build a go-to resource that defines how to lead your organization through an activist situation. In times like these, IR has a unique opportunity to shine and guide their C-suite through a high stakes situation.

Whether it’s responding to a proxy fight or working to calm current investors after the issuing of negative public statements towards your CEO or board, IR needs to step up and steer the ship with a structured approach. Laying out exactly how you would engage third party advisors, work with your board, stay close to your shareholder base, and cover analysts are all key things to consider when preparing your guide.

Having such a playbook at the ready, created in partnership with a surveillance expert like Q4, can be a key insurance policy should a combative situation arise.

Increase Visibility

From our experience, increasing visibility is overarchingly the most important thing IR can do to get ready preparing for an activist considering knowing if an activist is circling is opaque. Most IR teams have an incomplete picture and activists have strategies at their disposal to hide positions, keeping them below regulatory disclosure requirements. Surveillance providers can help IR gain insight into this by looking at DTC flows, live stock monitoring, options activity, and broker position builds but this still leaves major blind spots.

From our work with clients, we’ve seen an increasing prevalence of activists deploying options and swap based strategies to build positions in issuers without making a formal filing. Therefore, augmenting traditional public markets data and brokers’ filing with data that shows investor website visits and recent event attendance can provide a more complete, 360 degree view and uncover clues indicating an activist is circling.

In several instances, Q4 has successfully identified the prevalence of an activist in our client’s stock early and notified management by triangulating DTC flows with event attendance and website visits.

If bringing on a dedicated surveillance team is not possible, Q4’s Engagement Analytics activist notification tools can act as an initial, self-serve way to bring visibility into latent activist risk and identify if an activist of note has been popping up on your website or earnings events.

The Bottom Line

Looking ahead to the rest of 2023, it’s clear 2022 activity is likely to continue. On the back of persistent economic uncertainty, the activist landscape remains robust with both new and well known players staying active.

No matter how you plan on dealing with activism this year, consider the benefits of preparing for an activist repsonse playbook in place and seeking to increase visibility at minimum. When it comes to higher activity sectors like Technology, Communications Services, Consumer Discretionary and Consumer Staples, bringing on a broader set of tools and support can make all the difference in ensuring IR is best positioned to the leader it needs to be should an activist knock.