As we prioritize and execute on our mission at Q4 — “to revolutionize investor relations (IR) by empowering teams with cutting-edge technology to drive enterprise value” — the future of IR is a topic we’re highly invested in. Through our technology, webinars, new blog series (“Profiles in IR”), research data and more, we aim to keep you apprised of current IR trends and priorities, along with “what’s next.” We know empowering IR pros in their roles means equipping them with the tools, community support and knowledge they need to “win” in the capital markets and stay future-ready.

To that end, we recently ran an online survey in conjunction with NIRI on “The Future of Investor Relations,” collecting data from IR officers (IROs) and other IR professionals across the globe. As generative AI (GenAI) continues to have a transformative impact on IR and the overall business landscape, we were interested to see IR teams’ outlook on the technology.

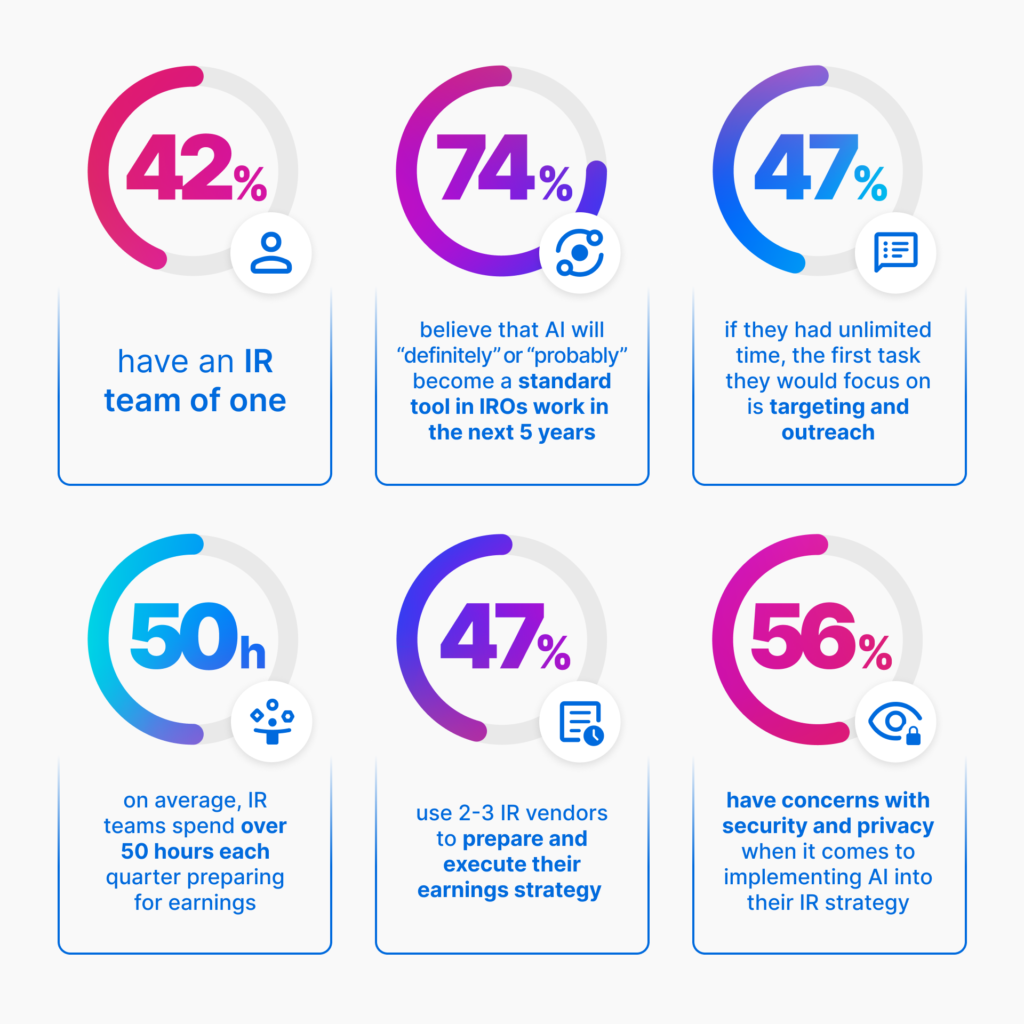

The survey says they’re eager to harness its potential: Nearly three-quarters of IR pros (74%) think AI will “definitely” or “probably” be a standard part of IR’s toolkit within the next five years. This pervasiveness speaks to the range of compelling use cases for AI (and specifically, GenAI) in IR — from summarizing meeting notes and market news, to conducting sentiment analysis, to drafting earnings scripts, and a lot more.

It also underscores an important shift in GenAI usage and perception: as forward-looking organizations move from leveraging it as solely an efficiency driver to exploiting its potential as a strategic collaborator, too. This is something we — and our customers — are especially excited about. By combining the vast data GenAI has access to with IR Ops Platform data (e.g., website, email and event analytics) and company-specific data as well (e.g., meeting notes), there’s an incredible opportunity to use AI in a consultant-like capacity… asking things like: “Where are the biggest opportunities to improve our valuation?” “What new investors should we be targeting?” and so on.

However, there are challenges to address and overcome first. IR pros say when it comes to implementing GenAI, their organizations’ top concerns include ensuring security and data privacy (56%) and knowing how to use it effectively (19%) — highlighting the need for secure AI and to maximize value through training.

The infographic below provides more key data points from the survey.

Additional insights around IR pros’ roles and job duties include:

- Small teams, big to-do lists: 9 in 10 IR pros (90%) belong to teams of 3 or fewer people. In fact, 42% are a team of 1.

- Who do IR pros report into? For 72%, it’s the CFO.

- Earnings prep is time-intensive: 42% of IR pros spend 60 hours or more on this each quarter; 66% spend 40+ hours.

- Maximizing ROI from IR tech: The top 3 things IR pros want from their tech stack are: the ability to target investors more effectively, drive more precision when targeting, and understand analyst and investor behavior across website and earnings events.

- If only I had the time… If they had unlimited time, IR pros would turn their efforts to activities, which they say they aren’t able to sufficiently address today. These include: targeting and outreach (47%), analyzing data and outcomes (22%), and building better relationships with investors (19%).

Looking for more insights and data on IR priorities, the evolving IR role and where AI fits in? We’re constantly examining topics like these. Check out another survey we conducted earlier this year (“The Evolving Role of the IRO”) for additional, actionable information.