Imagine this: You’re walking into a last-minute investor meeting. Even before you begin, the prep work is complete: A personalized investor summary appears in your inbox, highlighting recent engagement history, post-earnings sentiment, the last question they asked, and a flag that their portfolio just shifted out of your sector.

You didn’t request it. You didn’t have time to prepare. And yet, you’re ready.

That’s the power of agentic AI.

While most AI-powered investor relations tools today focus on answering a question or executing a command, agentic AI in investor relations works differently. It acts on your behalf, understands the context you operate in, and pursues meaningful outcomes without waiting to be asked.

This article is part one of a three-part series exploring how agentic AI is redefining the role of investor relations, from what it is, to how it works, to how IROs can get started.

So, what exactly is an AI agent?

At its core, an AI agent is software designed to sense, reason, and take action. Instead of needing step-by-step instructions, it works toward a goal, like ensuring you’re prepared for an earnings call or keeping tabs on investor sentiment after a roadshow.

This isn’t automation in the traditional sense. Think of it as an extra member on your IR team: one that never sleeps, learns quickly, and knows what matters to you and your stakeholders.

Three traits set agentic AI apart:

- It works with purpose. You give it a goal, and it figures out how to get there, whether that means pulling engagement data, drafting materials, or highlighting risks.

- It understands your world. It remembers which investors you met last quarter, what questions they asked, and what has changed since.

- It initiates action. When something important happens—a market shift, a flagged sentiment trend, an investor behavior anomaly—it acts.

How does it differ from traditional AI tools?

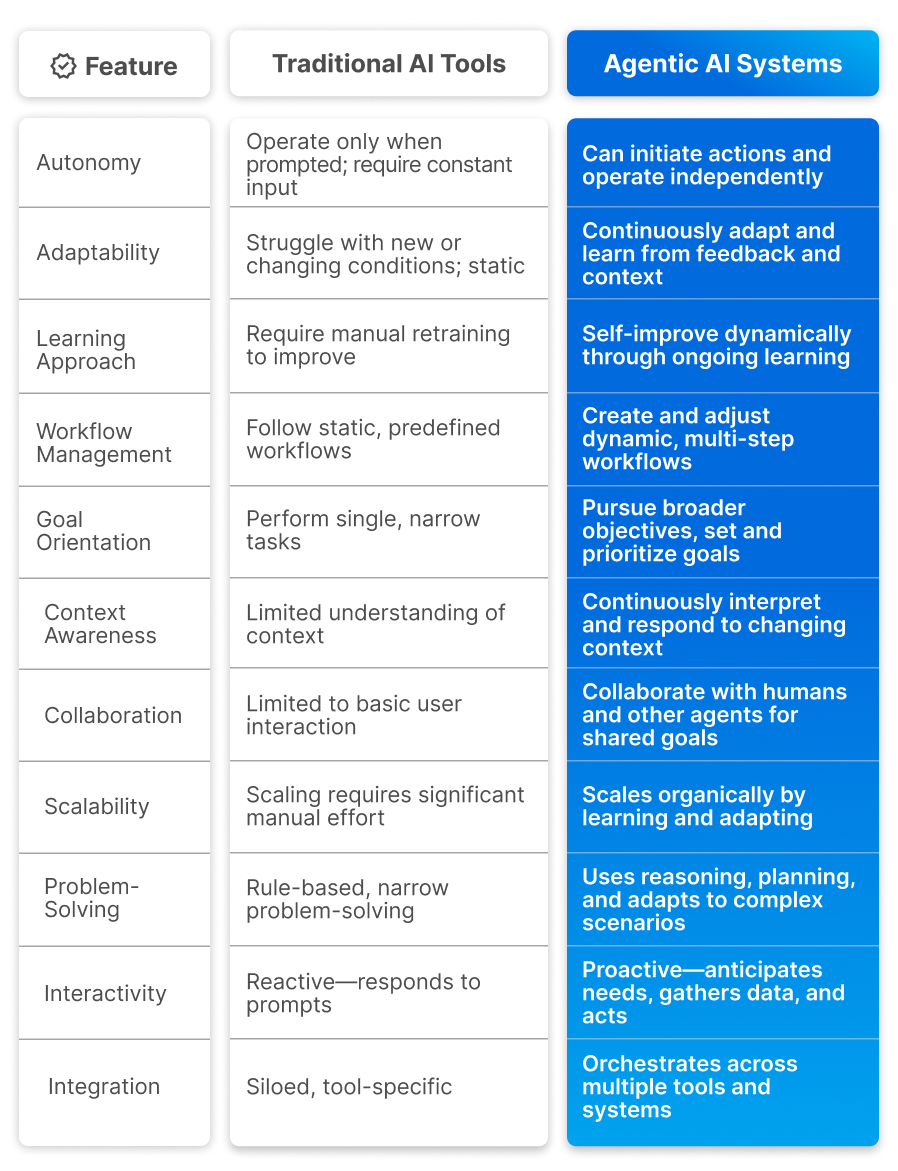

Many IR teams already use AI-powered features embedded in their platforms, like sentiment tagging, transcription, or keyword alerts. These tools are reactive: they perform a narrow task when you ask. By contrast, agentic AI systems for investor relations are proactive. It fits into how your team already works and gets smarter over time, more like a teammate than a tool.

Here is a detailed breakdown of the differences:

How do AI agents work in the context of investor relations?

AI agents operate through a structured, iterative process that mirrors how an experienced team member might approach a task: gathering information, evaluating options, and executing with context. This process typically includes four core stages:

1. Goal setting

The agent begins with a clearly-defined objective provided by a user, for e.g., “Track investor engagement after our earnings call” or set at a system level based on recurring needs such as “Generate briefing notes for tomorrow’s meetings”. The agent uses this goal as its strategic anchor, aligning each action with the broader objective rather than executing tasks in isolation.

2. Data acquisition

Once the goal is defined, the agent collects the information it needs. In the context of investor relations, that often includes:

- Internal sources such as meeting notes, earnings transcripts, or past Q&A responses

- Engagement data like which documents were accessed, how long they were viewed, and by whom

- External signals, such as analyst commentary or relevant financial news

The agent transforms raw data into actionable context, providing a decision-ready, real-time view to prioritize actions that align with your strategic objectives.

3. Decision-making

With relevant data assembled, the agent enters its decision-making phase. Here, it processes and interprets the information: identifying patterns, assessing risks, and weighing potential actions against the original objective.

It combines analytics, business logic, and machine learning to determine the optimal next move. For instance, if the agent detects a drop in engagement from a key investor following an earnings call, it may flag this as a priority and recommend a targeted follow-up.

4. Task Execution

Once a decision is made, the agent seamlessly moves to execution: whether that’s generating a report, sending a draft response for review, or prompting you with a next-best action. The agent doesn’t stop there. It monitors the outcomes of its actions, such as whether a report was opened or a follow-up led to renewed engagement, and incorporates these results to refine future decisions. This feedback loop ensures the agent continually improves its effectiveness, delivering more value over time.

Let’s take a closer look at how this plays out in practice, specifically, how an AI agent supports an IR team in the high-pressure moments following an earnings call.

The infographic below illustrates the workflow in action:

You’ve just finished a high-stakes earnings call. The market is reacting, your inbox is filling with investor queries, and analyst commentary is pouring in. Instead of scrambling, your AI agent steps in to transform this flood of information into actionable insight.

What is next?

Agentic AI for investor relations brings a new layer of intelligence to IR, reducing manual load while enhancing strategic responsiveness. To see its full value, the next part of this series explores real-world use cases that show agentic AI in action across the investor journey.

Need a reference?

Download the Agentic AI Glossary for IROs, a quick, clear reference guide to help you stay fluent as this technology evolves.