We don’t have to tell you that the job of Investor Relations continues to get harder, not easier. As public companies face market volatility, economic uncertainty, increased activism, growing retail investment, and ongoing digital transformation, IR teams are faced with a daunting task: perform at an even higher standard in terms of investor relations effective targeting with limited resources. So what does it take for IROs to continue to thrive in this landscape, particularly when it comes to targeting high-value buy-side investors?

Investor Relations Effective Targeting Efforts Often Fall Short

We know that effective targeting is critical to find and win value-driven shareholders who are committed to our value propositions. But we also know that it’s usually a challenging, time-consuming, and often manual process to do so. In fact, it leaves some IR teams struggling with effectiveness and others abandoning the process of proactive targeting altogether.

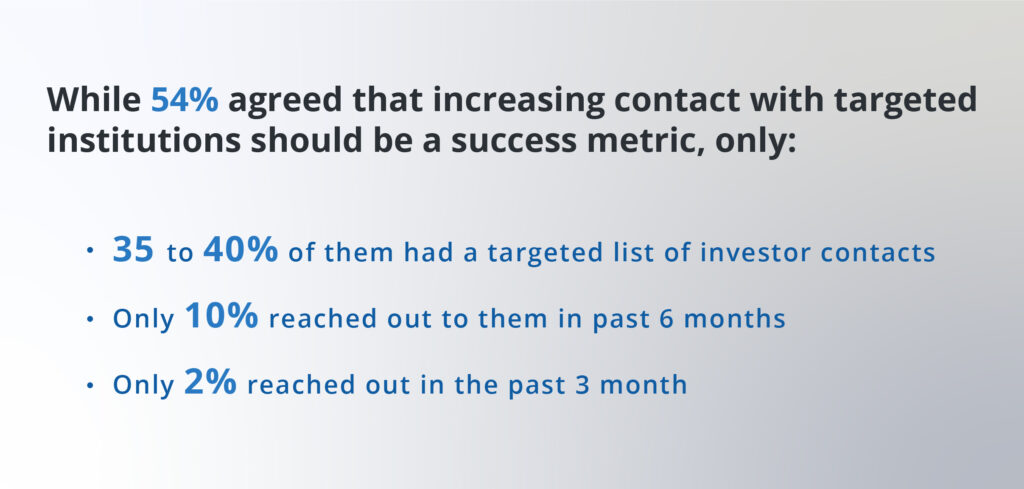

An informal poll was conducted at the most recent NIRI conference. With about 100 people in the room, a panel of speakers asked IR attendees to provide insight into their targeting efforts. You might find the results surprising:

Targeting with Behavioral Analytics: A Use Case

Q4 has spent the last several months working on a solution to this principal dilemma: What would it take to make targeting easier, more efficient, and more successful for IROs?

We believe that effective use of engagement analytics data, combined with automated intelligence, is a foundational must have. To test our theory, we developed a use case detailing how one Investor Relations team used these tools to identify and win a high priority target.

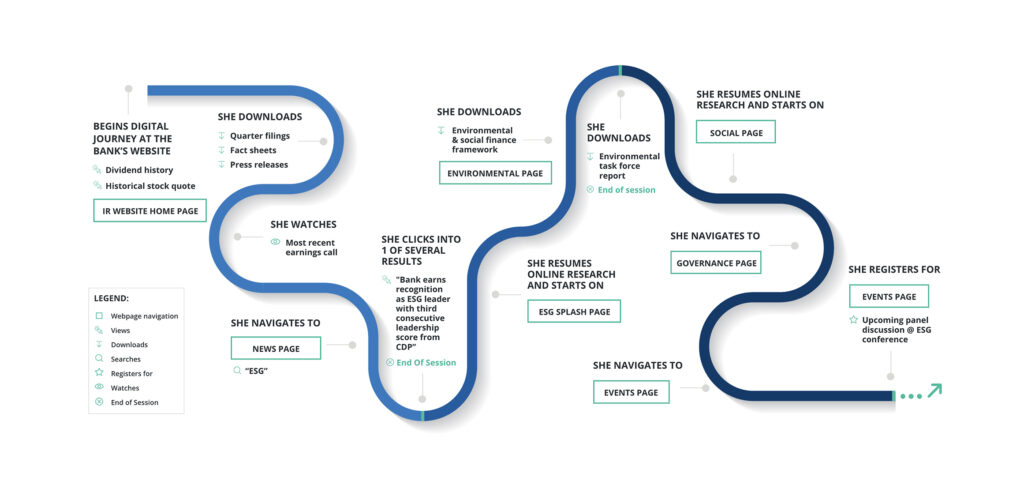

Sally, a fund manager, wanted to add an ESG-focused bank to her portfolio. Using engagement analytics and automated intelligence, the IR team at the bank was able to track Sally’s digital behavior and surface her (via her unique IP address) as an immediate high-value target investor with a high propensity to convert.

What’s the outcome?

After identifying Sally as a priority target, the system provided the bank’s IR team with critical details regarding Sally’s interests and preferences and suggested the most appropriate contact channels, formats, topics, and internal colleagues with which to engage her. Then:

- The Chief Sustainability Officer (CSO) of the bank reached out to Sally personally and directly, asking Sally if she’d like to meet to discuss the bank’s ESG program.

- The CSO provided Sally a link to more detailed ESG content and the results of a recent competitive ranking against ESG criteria where the bank performed well.

- Sally met with the CSO and attended the bank’s next online ESG event.

- Ultimately, Sally added the bank’s stock to her portfolio.

Interested in learning more about this IRO’s journey? Q4’s vision? How Q4 solutions can help? Get in touch!

To see the thoughts of our CEO on using these tools to measure your IR Strategy, you can view his interview with IR Magazine: