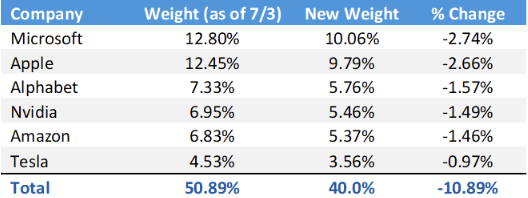

Last Monday, a Nasdaq-100 special rebalance took effect to remain properly diversified. Typically, the Nasdaq-100 rebalances once a year in December. Still, an early rebalance was warranted, given that the cumulative weight of constituents worth more than 4.5% of the index had risen to 50.9% as of July 3rd. The benchmark’s methodology states that this number should not exceed 48%.

By ensuring that the index remains diversified, Nasdaq is, in turn, reducing the concentration risk of billions of dollars managed by index funds and ETFs that use the Nasdaq-100 as a benchmark.

How Did the Nasdaq-100 Wind Up So Top Heavy?

After immense pressure in 2022, growth and technology names have been the drivers of a red-hot rally in 2023. To put this into perspective, the tech-heavy Nasdaq has surged 33.6% YTD, far outpacing the broad-based S&P 500, which is up 17.6% YTD (as of 8/2).

The seven most significant Nasdaq-100 components have also been some of the biggest beneficiaries of the recent rally, which has earned this group of companies, composed of Microsoft, Apple, Alphabet, Nvidia, Amazon, Tesla, and Meta, the nickname “Magnificent Seven.” These companies have risen to a combined market cap of $11 trillion, causing their respective Nasdaq-100 weightings to soar. The only member of this group which fell under the 4.5% threshold at the time the rebalance was announced was Meta Platforms.

Nasdaq-100 Weighting Decreases