Key Takeaways

Global equities began the year continuing recovery trends seen in a volatile 2020. Mass vaccine distribution and subdued lockdown restrictions drove economic renormalization momentum, however exposure of previously unknown Covid-19 variants delayed recovery paths. These headwinds aside, the global gross domestic product grew, demonstrating cyclical economic progression through from recovery to expansion and ultimately outperforming its pre-pandemic peak.

- Stock markets continued to grind higher in 2021, with the S&P surpassing a series of record closing all time highs and ending the year near a record

- While Covid-19 continued to dominate headlines, concerns also focused on inflation and its potential impact

- Investors demonstrated record breaking demand for ESG exposure through new fund initiations and fund flows.

It was a year of uncertainty, anticipation and hope for a return to a degree of normalcy following the onset of the Covid-19 pandemic. When everyday vocabulary grew to revolve around terms like fiscal stimulus, ESG, meme stocks, interest rates and inflation. Investors poured almost $1.2 trillion into equity exchange-traded and long-only funds in 2021 – exceeding the combined total from the past 19 years.

Despite sociomedical challenges straining markets, global economic issues arose like labor shortages, supply chain issues and rising inflation. Food and energy prices confronted swift price increases and the US consumer price index jumped 7% YoY – an increase not experienced in over 40 years.

Through the course of 2021, US markets continued a relatively steady rally, with the Dow Jones Industrial Average returning 18.7%, the leading S&P 500 reporting gains of 26.9% and the Nasdaq Composite yielding 21.4%. In addition to modern medicine supplying functional vaccines, market momentum was met with record corporate earnings and increased consumer demand. US corporations smashed record profits, both in dollar terms and as a share of GDP (11%) while consumer spending predominantly trended higher throughout the year, rebounding from pandemic lows.

Global markets continued to rise alongside those in the US, despite some setbacks. Markets that started the year strong were up and down in the year’s second half but still near all-time highs. Global equities, as measured by the MSCI All Country World Index increased 18.54%. Developed international stocks, as represented by the MSCI World ex USA Index, rose 12.62%, notably stronger than emerging markets, which saw the MSCI emerging Markets Index fall –2.54%.

Markets Roadmap to Economic Renormalization

With the S&P 500 returning a modest 26.9% in 2021, the energy sector was the strongest performer which returned 47.6% driven by increased demand from pre-pandemic levels along with inflationary pricing pressures. The Big Three refiners — Marathon Petroleum, Valero, and Phillips 66 — gained an average of 36.6% for the year. Marathon was the best performer in the group with a gain of 61.0%. Utilities lagged the group as increased fiscal stimulus and slowed share price momentum turned investors attention to sectors trading at higher market multiples or directly impacted by the low interest rate environment such as information technology and real estate which performed 3rd and 2nd best, respectively.

ETF and Long-Only net inflows smashed through record pace not seen in almost 2 decades – Passive funds raked in $958 billion in 2021, over $700 billion more than their active counterparts. The demonstration of strong investor demand emphasizes just how astounding and record-breaking 2021 was. “Cheap” debt and an exponential increase in demand transitioning through the economic cycle set the stage of an unstoppable rally, with frenzied retail trading and a lack of other good investment options adding fuel to the fire.

Proof is in the Pudding

As Covid-19 lockdown restrictions eased, consumer demand increased exponentially as the global economic cycle shifted from recovery to expansion. Global manufacturers struggled sourcing labor and raw materials to keep up with order flow driving demand for shipping services. According to Freightos Data, which tracks the global container freight index, average container costs opened the year at $3,452/ctr, rose to 2021 high of $11,109/ctr in September and finished the year at $9,680/ctr – highlighting an almost 3x increase YoY.

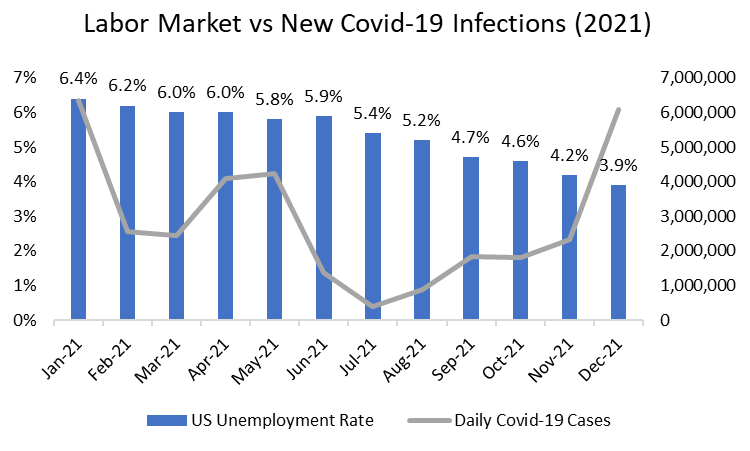

In the US economy, employees of the workforce that were able, turned to a work-from-home environment in 2020 with the onset of the pandemic and continued trends into early 2021. Professionals who focused on in-person services like hospitality, creative arts and manufacturing faced longer periods to re-enter into the economy. According to the CDC – over 6.3 million Americans reported new Covid-19 cases in January, however as the US rolled out its vaccine distributions, the number of daily cases fell in March to a 1Q’21 low of 2.4M new cases. The decrease in infections and increase in vaccinations drove businesses to move back to in-person as lockdowns eased. The emergence and termination of the Delta variant headwinds seen in 2Q’21 drove new Covid-19 cases to the 2021 low of just 392K cases in July. However, the Omicron variant brought on new challenges late into the year, increasing the infection rate nearly to levels seen at the beginning of the year.

The labor market tightened in 2021 – US unemployment moved from 6.4% to ending the year at 3.9%. 2021 Fiscal policy decisions were driven by hard economic data. Jerome Powell and the Fed in conjunction with Congress issued stimulus payments, tax credits and extended unemployment benefits driven by the volatility of Covid-19 variants. Despite the full surge in Omicron variant cases in December, the labor market held steady.

Green Return to Our Planet and Portfolios

Environmental, Social and Governance (ESG) focused investing has gained momentum over the past decade. Google trends data, which tracks how popular a search term is used on a scale of 0-100 (0 being not enough data, 50 as half as popular and 100 as peak popular) shows the search term “ESG ” doubled to peak popularity in 2021, reaching a value of 99 from 51 in 2020. Investment houses and proxy firms have adjusted their investment guidelines prudently to include ESG focused transitions which have now stepped into the main spotlight. For example, mega-fund manager BlackRock, who issued its 2022 Proxy Voting Policy, recommended companies focus on actions such as issuing net carbon ratings beginning in 2023, industry-specific sustainability reporting and transitioning to greater boardroom diversity.

According to Morningstar, for the sixth calendar year in a row, sustainable funds set an annual record for net flows in 2021. Since the fourth quarter of 2019, assets have reached far higher levels. In 2016, 2017 and 2018 annual flows hovered around $5 billion per year, with modest increases each year. Then in 2019, flows increased fourfold to $21.4 billion, with $7 billion of that coming in the fourth quarter. That record was smashed in 2020, as flows reached $51.1 billion and again was easily eclipsed in 2021 – setting a record $120 billion in funds flow.

When Breaking Records Sounds Like a Broken Record

2021 was truly a remarkable year for stock markets – continuation of record breaking momentum shifting out of the Covid-19 induced pandemic and new trends set from buy & sell sides alike. According to systematic investor Dimensional Fund Advisors, investors may have a tendency to think markets reaching a new high is a signal stocks are overvalued or have approached a ceiling. Such concerns may be especially prevalent now, with the S&P 500 having notched 75 closing records in 2021 on a total-return basis. However, investors may be surprised to find that the average returns one, three, and five years after a new month-end market high are similar to the average returns over any one, three or five-year period. For instance, in looking at monthly returns between 1926 and 2021 for the S&P 500 Index, 30% of the monthly observations were new highs. After those highs, the average annualized compound returns ranged from over 14% one year later to more than 10% over the next five years. Those results were close to the average returns over any given period of the same length.