Welcome back to our weekly earnings topics 2022 recap on trending topics, macro trends and key management commentary highlighted from earnings call transcripts of S&P 500 companies for the Q4’21 earnings season. With BofA, Goldman Sachs, BNY Mellon & Morgan Stanley among the few big names that reported last week, here are some trending topics that emerged during earnings updates from the week of January 17th, 2022:

- Earnings Q&A Analysis: We delved into analyst FAQ’s of S&P 500 Regional Banks who have reported 4Q 2021 earnings calls thus far. Read on for a detailed summary of the topics that are generating the most questions.

Banks are wary of Net Interest Margin (“NIM”) compression and the impact on their profitability due to various factors, including reduced fees from the Paycheck Protection Program (PPP) loans and minimal mortgage banking in Q3, as well as low interest rates that are expected to improve with the Federal Reserve poised to implement rate hikes in 2022, which should lead to an uptick in NIM.

Net interest margin and core net interest margin performed in line with our guidance. Reported net interest margin declined 5 basis points, 2 basis points due to purchase accounting accretion and 3 basis points from core. The main drivers of the 3 basis points decline in core net interest margin were the impacts of lower PPP revenue and higher levels of liquidity. The PPP continues to wind down and we expect to earn an additional $60 million of PPP revenue over the coming two quarters.

- Daryl N. Bible – Truist Financial Corp., Chief Financial Officer

Sequentially, net interest margin remained relatively stable. On a year-over-year basis, Net Interest Income was flat. Also on a year-over-year basis, average deposits grew in the quarter as we continued to deepen relationships with our institutional clients as well as our consumer clients, particularly in North America. Average loans were roughly flat year-over-year as growth in the ICG was offset by a decline in GCB. As the probability of higher rates has increased over the last few quarters, let me make a few comments regarding the potential impact from higher rates…Assuming a static balance sheet and a 100-basis point parallel shift, we would expect Citi’s total Net Interest Income across all currencies to increase by over three times more than what was disclosed in our third quarter 10-Q, or roughly $2.5 billion to $3 billion of Net Interest Income.

- Mark A. L. Mason – Citigroup, Inc., Chief Financial Officer

Mortgage fees declined in the quarter against the backdrop of strong competition in excess industry capacity. We saw ongoing pressure on gain on sale margins, particularly in third-party channels and seasonally lower production volume…We expect NII to be down about 1% despite solid loan growth, given a $20 million smaller contribution from PPP and an $18 million impact from lower day count. Including the impact from HSBC, NII will be broadly stable for the quarter. Average volumes are expected to be up 2% to 3% with interest-earning assets broadly stable. Fees are expected to be down 8% to 12%, reflecting seasonally lower capital market fees than the record we delivered last quarter as well as other seasonal impacts.

- John F. Woods – Citizens Financial Group, Inc. (Rhode Island), Vice Chairman & Chief Financial Officer

Now, let me provide some guidance for the full-year 2022. Loan growth is expected to be in the mid-teens. Our net interest margin is expected to be in the range of 2.65% to 2.75%. Given our high level of cash, we currently expect to operate near the lower end of this range. Efficiency ratio is expected to be in the range of 62% to 64%. As a reminder, our first quarter efficiency ratio is typically higher, due to the seasonal impact of payroll taxes and benefits. With respect to income taxes, the full-year tax rate is expected to be in the range of 20% to 21%. Overall, it was a very strong quarter and year.

- Olga Tsokova – First Republic Bank (San Francisco, California), Executive Vice President, Acting Chief Financial Officer & Chief Accounting Officer

While COVID has been an ongoing topic of discussion and scrutiny on a global scale, companies have started to provide their outlook this earnings season on how their businesses have been impacted so far due to the pandemic, and how they intend to account for COVID in 2022.

I’d like to update you on how COVID has impacted our operations. Like other businesses, we have experienced moderately higher levels of attrition and more unplanned absences. We had prepared for the situation to increase recruiting capacity as well as meaningfully upgraded digital capabilities to improve customer experience and reduce call volumes. As a result, in the first two weeks of 2022, traditionally our most demanding period, we were able to service the needs of our patients and customers. At the same time, we responded swiftly to the federal mandate for cash-free COVID tests for consumers, a highly complex undertaking.

- Dirk McMahon – UnitedHealth Group, Inc., President & Chief Operating Officer

To conclude, our business exhibited strong momentum well before the COVID crisis. We’ve strengthened our position further during the crisis, and we believe P&G is well positioned to grow beyond the crisis. We will manage through the near term cost pressures and continued market level volatility with the strategy we’ve outlined many times and against the immediate priorities of ensuring employee health and safety, maximizing availability of our products, and helping society overcome the COVID challenges that still exist in many parts of the world. We’ll continue to step forward toward our opportunities, and remain fully invested in our business.

- Andre Schulten – Procter & Gamble Co., Chief Financial Officer

When we talk and look at the impacts of COVID-19 and how we think about it on a future basis, we now consider COVID-19 to be merely an ongoing element of our global business environment. And like all of society, we have to learn how to live with it. The first step for us is recognizing it for what it is. It’s a serious virus, but we – but our approach is not one of fear and chaos. It’s an approach to sharing the facts of our customers and our employees, what we’re doing and how we’re handling it day to day…our Onsite signings and our FMI device signings have been meaningfully impacted by COVID over the last two years. However, we future is untainted by this. And if anything, it’s strengthened because the definition of who is the potential customer has expanded dramatically during this timeframe.

- Daniel Lars Florness – Fastenal Co., President, Chief Executive Officer & Director

To our customers who have been affected, we appreciate your patience and your understanding. The good news is that over the past seven days, our operation has stabilized, with Omicron-related cancellations impacting only about 1% of our flights. And since Sunday, the number of Omicron-affected cancellations are around 20 a day out of nearly 4,000 daily flights. And, in fact, yesterday, we only had two Omicron-related mainline cancellations. So while the new variant is not done, it appears that the worst may be behind us. Based on how quickly the case counts have risen, our medical team expects cases to peak in the US over the next few days followed by a steep decline in cases. And we’re already starting to see that happen amongst our own staff. Given the high transmissibility and lower severity of Omicron, this variant is likely to mark the shift in COVID-19 from being a pandemic to a manageable and ordinary seasonal virus which should accelerate the path to a normalized environment.

- Edward Herman Bastian – Delta Air Lines, Inc., Chief Executive Officer & Director

The year kicks off with the news of a mega-acquisition as Microsoft agrees to purchase Activision for $68.7 Billion, and the topic of M&A is trending across the board as executives share their plans on how they wish to incorporate acquisitions in their 2022 guidance and reflects on it’s impact on their earnings so far.

Our approach to mergers and acquisitions is to focus on TAM expansive opportunities in high-growth markets, where we can uniquely add value to the users or the community. And we execute those transactions at a price that supports long-term shareholder value creation. You have heard from Satya, Bobby and Phil that Activision Blizzard meets those criteria. And with all acquisitions, value is ultimately created through terrific execution by an aligned team of talented, creative individuals with a shared vision of the future.

With this acquisition, we continue to deepen our commitment to the 3 pillars of our gaming strategy: content, community and cloud. Key measures of our success include accelerated revenue growth from Activision Blizzard’s game portfolio as we extend content to more devices, resulting in increased engagement and monetization across the Xbox platform; as well as additional growth in Game Pass subscribers as we attract new players wherever they play and continue to build one of the most compelling and diverse lineups of AAA content available.

- Amy E. Hood – Microsoft Corporation, Executive VP & CFO

In Institutional Securities, we showed strength and gained share, and in Wealth Management, we added over $430 billion of net new assets, bringing total client assets to nearly $5 trillion. We drove our strategic vision forward in Investment Management, successfully closing our acquisition of Eaton Vance earlier in the year, and created a premier asset manager which itself has $1.6 trillion of assets under management…Clearly, the firm’s performance exceeded the expectations we had for 2021 heading into that year. With the early successes of the E*TRADE and Eaton Vance acquisitions and the firm’s overall momentum, we entered 2022 ahead of plan.

- James Patrick Gorman – Morgan Stanley, Chairman & Chief Executive Officer

Together, we accomplished a great deal in 2021, including higher fee and total revenue generation, successful execution against both sales effectiveness and client retention goals that is driving growth and business momentum, as well as announcing the proposed acquisition of Brown Brothers Harriman Investor Services, all of this would not have been possible without our employees’ hard work, skills and commitment…the successful integration of BBH Investor Services is a key priority. The proposed acquisition is a financially compelling use of capital. And once closed, it will strengthen our market leadership by creating the world’s largest custodian, expand and deepen our international reach, further propel our Alpha strategy and add strong talent that will supplement our focus on client and service excellence and expertise.

- Ronald Philip O’Hanley – State Street Corp., Chairman, President & Chief Executive Officer

The [BBVA] acquisition positions us with a coast-to-coast presence and along with our continued organic growth strategies, including our recent expansion into Las Vegas, we now have a presence in all of the top 30 US markets. We’re excited about the opportunity this presents, and we are confident in our ability to generate growth by executing on our Main Street relationship-based model. That said, we recognize that we have a lot of work to do in building out the new and expansion markets, which will be our primary focus in 2022.

BBVA obviously impacted our results for the full year, and Rob will walk you through the details. Excluding BBVA, we generated record revenue, highlighted by strong noninterest income with broad-based contributions across our commercial and consumer businesses.

- William Stanton Demchak – The PNC Financial Services Group, Inc., Chairman, President & Chief Executive Officer

Earnings Q&A Analysis

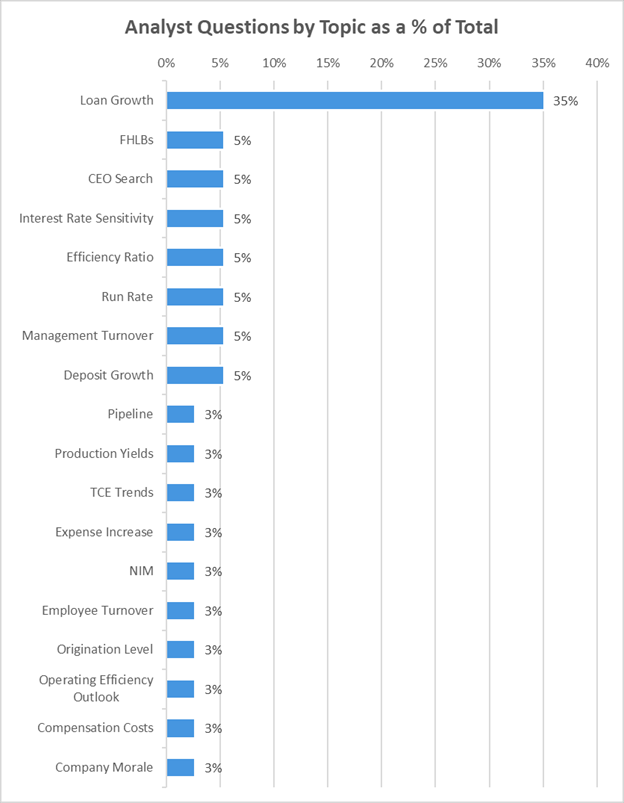

The data referenced below isThe data referenced below is based on Q4’s proprietary analysis performed on the Earnings Call Q&A sessions of S&P 500 organizations within the “Regional Banks” industry (SBNY, PNC, TFC, CFG, CMA) that reported earnings last week. The chart below highlights the key topics that analyst queries focused on in those calls, displayed as a % of all questions asked.

As per the chart, Loan Growth was the key trending topic being addressed by Regional Banks, covering 35% of all questions asked. FHLBs, Search for CEOs, Interest Rate Sensitivity, Efficiency & Run Ratios, as well as Management Turnover and Deposit Growth were tied for 2nd place with about 35% (cumulative) of questions mentioning these topics.

About 52% of all questions focused on topics related to Guidance, while 41% focused on Business Drivers, as companies report on their 2022 outlook/guidance during this earnings season.